The world furniture industry under the COVID-19 epidemic

- 2021-09-09

On the day of Teacher’s Day on September 28, 2020, the number of deaths due to the COVID-19 epidemic in the world exceeded one million. Affected by this epidemic, people’s lifestyles may be changed, including daily social interaction, work, shopping, communication and entertainment, etc., but also derived New demand business opportunities (Stephen Su et al., 2020). For example, the number of shoppers in stores in various countries has dropped sharply, from -32% in China to -80% in Mexico, physical stores have been hit, and the online shopping market has been greatly affected during the epidemic. Expansion (Laura Jones et al., 2020). In the six months since the outbreak of the epidemic, the global border blockade and crowd control have affected the furniture industry. For example, the well-known international furniture sofa NATUZZI was affected by COVID-19. The overall sales in September 2020 were 33.1% less than the same period in 2019 (Slaughter , 2020), Bassett furniture sales in the third quarter also fell by 16.3% (Russell, 2020). Therefore, this article does a little discussion on the world's furniture production and consumption in order to understand the current situation.

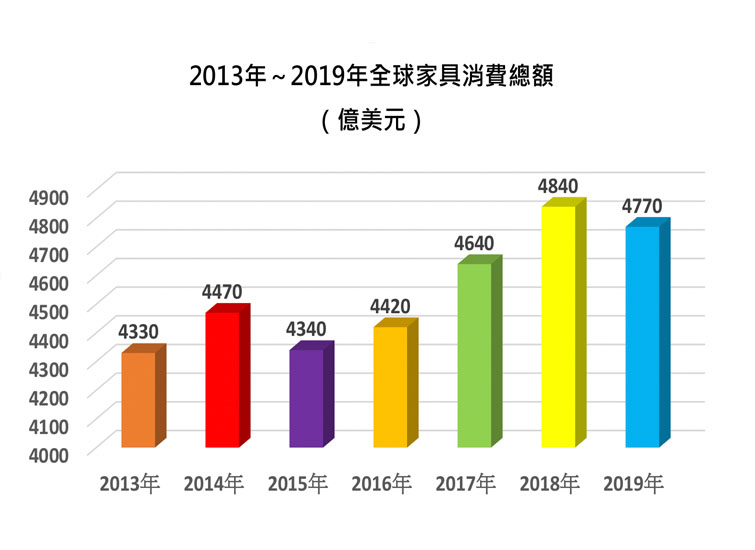

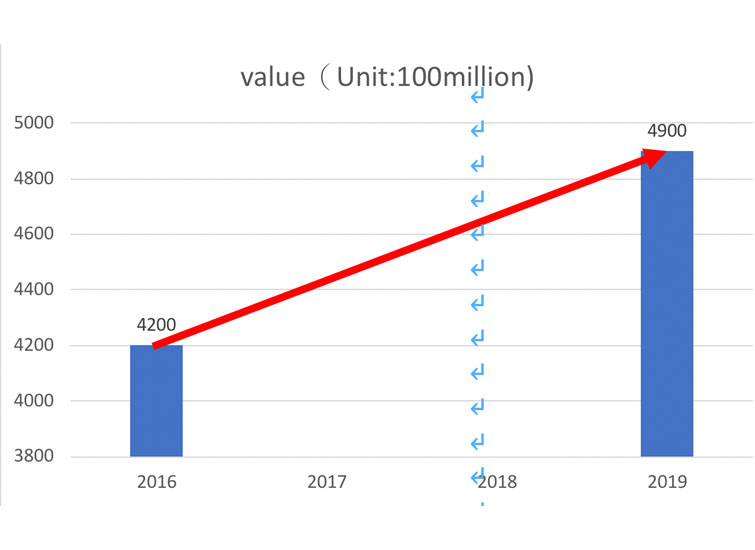

In the past 10 years, the international furniture trade has grown significantly. According to Centro Studi Industrial Leggera, (CSIL), the world furniture industry production value reached US$490 billion in 2019, and the world furniture consumption value reached US$ US$477 billion is shown in Figure 1 and Figure 2 (Finance, 2020), which contributes about 1% to the overall manufacturing industry’s international trade each year.

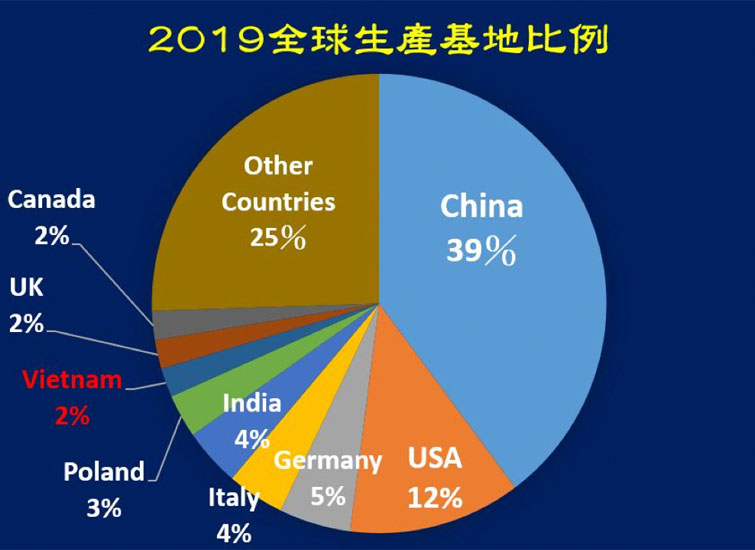

In the era of globalization, several countries have kept a pace of progress and have maintained global furniture production bases for many years. Figure 3 shows the proportion of furniture production in each region.

In the era of globalization, several countries have kept a pace of progress and have maintained global furniture production bases for many years. Figure 3 shows the proportion of furniture production in each region.

At present, China is still the largest furniture producer, accounting for 39%. The other major producers are the United States, Germany, Italy, India, Poland, Japan, Vietnam, the United Kingdom and Canada in order. However, Vietnam has gradually become the world's manufacturing factory. Especially in 2018, due to Trump's trade policy, a large number of China furniture factories migrated to Vietnam for production. Vietnam has become the world's seventh largest wooden furniture production base (CSIL, 2019). Sustained demand increases and plays an important role in the world's furniture production.

In the past 10 years, China has witnessed an unprecedented growth period in global furniture production. China has become a world leader in furniture production. This substantial growth has been accompanied by export-driven, industrial production, foreign investment, and abundant human capital and low-cost production have made China highly competitive in the international market. This competitiveness is due to the large-scale migration of Taiwanese furniture factories to Vietnam in 2000, and the large-scale migration of mainland-funded furniture factories to Vietnam in 2018. China’s competitiveness is decreasing year by year.

In the past 10 years, the United States has been the engine for the growth of furniture on the international stage. However, its growth depends on low labor cost suppliers such as China, Vietnam, Indonesia, etc. This has led to the closure of many furniture factories in the United States and the gradual weakening of the American furniture industry. Interestingly, high-quality furniture made of precious wood and carved is imported from China from neighboring countries such as Vietnam and Malaysia (Csanady et.al., 2019).

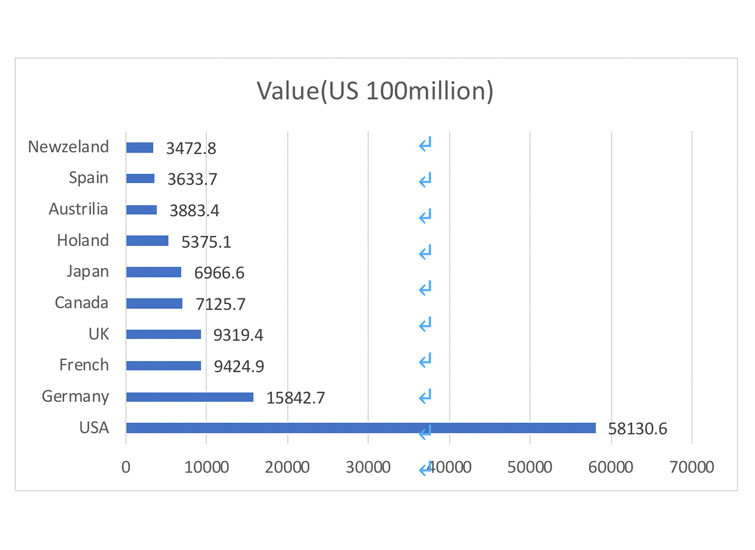

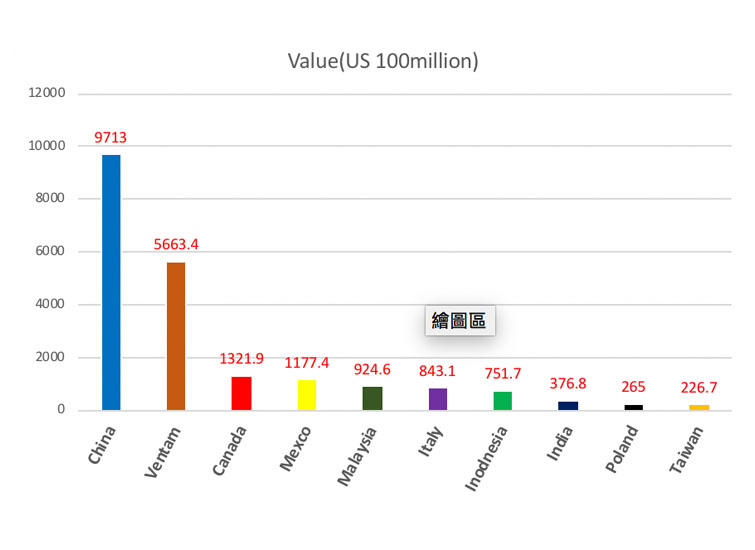

Based on the above, according to the "2019 Global Furniture Development and Outlook" research report released by the International Industrial Research Center (CSIL, 2020), in 2019, the United States will still be the world's largest furniture importer, followed by Germany, France, the United Kingdom and Canada. Europe and the United States are the world's major furniture consumers, and the top 10 sources of imported furniture from the United States are China and Vietnam, as shown in Figure 4 (Statista, 2020a) and Figure 5 (Statista, 2020b).

At present, China is still the largest furniture producer, accounting for 39%. The other major producers are the United States, Germany, Italy, India, Poland, Japan, Vietnam, the United Kingdom and Canada in order. However, Vietnam has gradually become the world's manufacturing factory. Especially in 2018, due to Trump's trade policy, a large number of China furniture factories migrated to Vietnam for production. Vietnam has become the world's seventh largest wooden furniture production base (CSIL, 2019). Sustained demand increases and plays an important role in the world's furniture production.

In the past 10 years, China has witnessed an unprecedented growth period in global furniture production. China has become a world leader in furniture production. This substantial growth has been accompanied by export-driven, industrial production, foreign investment, and abundant human capital and low-cost production have made China highly competitive in the international market. This competitiveness is due to the large-scale migration of Taiwanese furniture factories to Vietnam in 2000, and the large-scale migration of mainland-funded furniture factories to Vietnam in 2018. China’s competitiveness is decreasing year by year.

In the past 10 years, the United States has been the engine for the growth of furniture on the international stage. However, its growth depends on low labor cost suppliers such as China, Vietnam, Indonesia, etc. This has led to the closure of many furniture factories in the United States and the gradual weakening of the American furniture industry. Interestingly, high-quality furniture made of precious wood and carved is imported from China from neighboring countries such as Vietnam and Malaysia (Csanady et.al., 2019).

Based on the above, according to the "2019 Global Furniture Development and Outlook" research report released by the International Industrial Research Center (CSIL, 2020), in 2019, the United States will still be the world's largest furniture importer, followed by Germany, France, the United Kingdom and Canada. Europe and the United States are the world's major furniture consumers, and the top 10 sources of imported furniture from the United States are China and Vietnam, as shown in Figure 4 (Statista, 2020a) and Figure 5 (Statista, 2020b).

During the period of the epidemic, changes in living or working patterns may affect the design or functional requirements of furniture, and even the transformation of furniture patterns. Here are two cases. One is "Work-from-home". The lockdown of the epidemic has caused a rapid increase in work-from-home. It seeks to connect with colleagues, friends, school or family, and begins to think about what crisis to face. The UniFor company of the Molteni group of companies in Italy stated that after the epidemic, about 33% of the company's employees went to work and about 45% of the remaining home workers (Guzzine, 2020). This type of home work has created a market demand for home office furniture (Home-office-furniture). According to the CSIL (2020) survey of the European home office furniture market, this demand comes from people who often or occasionally work at home. It is estimated The potential number of people working at home in Europe is 830 million, of which Germany, the United Kingdom, and France rank among the top 3 (Figure 6). As the European market traditionally uses Ready-to-assemble-furniture and low-budget furniture, this wave of epidemic is bound to have a significant impact.

During the period of the epidemic, changes in living or working patterns may affect the design or functional requirements of furniture, and even the transformation of furniture patterns. Here are two cases. One is "Work-from-home". The lockdown of the epidemic has caused a rapid increase in work-from-home. It seeks to connect with colleagues, friends, school or family, and begins to think about what crisis to face. The UniFor company of the Molteni group of companies in Italy stated that after the epidemic, about 33% of the company's employees went to work and about 45% of the remaining home workers (Guzzine, 2020). This type of home work has created a market demand for home office furniture (Home-office-furniture). According to the CSIL (2020) survey of the European home office furniture market, this demand comes from people who often or occasionally work at home. It is estimated The potential number of people working at home in Europe is 830 million, of which Germany, the United Kingdom, and France rank among the top 3 (Figure 6). As the European market traditionally uses Ready-to-assemble-furniture and low-budget furniture, this wave of epidemic is bound to have a significant impact.

The second is furniture hygiene become more important in the post-epidemic era. In large open spaces such as community centers, shopping malls, universities, stations, airports, and hospitals, the public furniture must be cleaned, disinfected and maintained properly and regularly. To meet the above requirements, attention should be paid to furniture installation or design and manufacturing:

1. Material selection: leather and cloth lining furniture tend to accumulate bacteria in cracks and wrinkles, while wood is used

This problem can be avoided, and the wood has natural antibacterial and antimicrobial properties, and the surface of the material dries quickly

Speed, unfavorable to the growth of bacteria.

2. Modular design: easy to clean the corners and gaps of furniture, providing a high degree of hygiene, safety and reliability environment. Modular design can also be flexible and free to design new shapes according to space or environmental to match the needs. Figure 7 shows a case of modularization of the Skane University Hospital in Sweden, and its public space. The chair brings the beauty of natural materials, and the product is easy to disinfect and maintain. This seat system can be Individually plan and improve the working environment (Kamel, 2020)

The second is furniture hygiene become more important in the post-epidemic era. In large open spaces such as community centers, shopping malls, universities, stations, airports, and hospitals, the public furniture must be cleaned, disinfected and maintained properly and regularly. To meet the above requirements, attention should be paid to furniture installation or design and manufacturing:

1. Material selection: leather and cloth lining furniture tend to accumulate bacteria in cracks and wrinkles, while wood is used

This problem can be avoided, and the wood has natural antibacterial and antimicrobial properties, and the surface of the material dries quickly

Speed, unfavorable to the growth of bacteria.

2. Modular design: easy to clean the corners and gaps of furniture, providing a high degree of hygiene, safety and reliability environment. Modular design can also be flexible and free to design new shapes according to space or environmental to match the needs. Figure 7 shows a case of modularization of the Skane University Hospital in Sweden, and its public space. The chair brings the beauty of natural materials, and the product is easy to disinfect and maintain. This seat system can be Individually plan and improve the working environment (Kamel, 2020)

In short, the COVID-19 epidemic has not yet eased, material supply and furniture demand are uncertain. The main production bases of Taiwanese furniture such as China, Vietnam, Malaysia, Indonesia, etc., are also affected by the epidemic, and production capacity is full of variables. Faced with the coming of the post-epidemic era , The furniture industry may need to rethink the expansion of digital processing applications, the use of low-environmental impact creative materials, and the health of employees more important than the company’s production capacity to meet the development of the new world furniture industry after the epidemic.

about the auther :

Professor, Wen-Ching Su

Furniture Engineering & CNC Technology

Dept. of Wood Based Materials and Design

National Chiayi University

Reference

1. Finance (2020) global furniture industry market status and development trend analysis.

Website: https://read01.com/BJK54xj.html#.XxqAwZ4zY2w。ClickClick on Aug 20th 2020

2. (Lora Jones, David Brown & Daniele Palumbo)(2020)The new crown epidemic hits the world economy, nine pictures at a glance

。BBC NEWS Chinese Version。

Website: https://www.bbc.com/zhongwen/trad/business-53249104。

Clikc on Aug 29th 2020。

3. (Stephen Su et al., 2020)Key report on the impact of the global pneumonia epidemic (COVID-19) on Taiwan's industries。IEK Industry Information Network.Website:

https://ieknet.iek.org.tw/iekrpt/rpt_open.aspx?actiontype=rpt&indu_idno=0&domain=0&rpt_idno=422294729。

Click on Sep 20th 2020。

4. Csanady, E., Z. Kovacs, E. Magoss, J. Ratnasingam (2019) Furniture

Production Processes :Theory to Practice. Optimum Design and

Manufacture of Wood Products. Springer Nature Swizerland.

5. CSIL(2020)World Furniture Outlook 2020/2021.

Website: https://www.moneydj.com/KMDJ/News/NewsViewer.aspx?a={bd684700-7279-4bb9-bea2-99fd6f50c493}.

Click on Aug 20th 2020.

6. CSIL(2020)Home office furniture market in Europe. Website:

https://www.worldfurnitureonline.com/research-market/the-european-market-home-office-furniture-0058515.html.

Click on Sep 26th 2020.

7. Guzzini, G. (2020) COVID-19 will change forever the industry of furniture, according to entrepreneurs. Website: https://www.domusweb.it/en/speciali/domusfordesign/2020/the-things-that-covid-19-will-change-forever-according-to-entrepreneurs-in-the-furnishing-world.html. Click on Sep 30th 2020.

8. kamel, A. (2020) Furniture hygiene in a post COVID-19 era. Website: https://greenfc.com/stories/furniture-hygiene. Click on Sep 16th 2020.

9. Russell, T.(2020) Bassett Furniture reports 16.3% drop in Q3 sales.

FurnitureToday. Website: https://www.furnituretoday.com/financial-results/.

Click on Oct 1st 2020.

10. Slaughter, P. (2020) Natuzzi Q2 sales off by a third. Furniture Today.

Website: https://www.furnituretoday.com/financial-results/natuzzi-q2-sales-off-by-a-third/. Click on Sep 29th 2020.

11.Statista (2020a) Leading 10 source countries of household furniture imports in the U.S. 2019.

Website: https://www.statista.com/statistics/673244/leading-source-countries-of-household-furniture-imports-us/

Click on Sep 16th 2020.

12.Statista (2020b) Leading importers of furniture worldwide 2018.

Website: https://www.statista.com/statistics/673244/leading-source-countries-of-household-furniture-imports-us/

Click on Oct 1st 2020.

In short, the COVID-19 epidemic has not yet eased, material supply and furniture demand are uncertain. The main production bases of Taiwanese furniture such as China, Vietnam, Malaysia, Indonesia, etc., are also affected by the epidemic, and production capacity is full of variables. Faced with the coming of the post-epidemic era , The furniture industry may need to rethink the expansion of digital processing applications, the use of low-environmental impact creative materials, and the health of employees more important than the company’s production capacity to meet the development of the new world furniture industry after the epidemic.

about the auther :

Professor, Wen-Ching Su

Furniture Engineering & CNC Technology

Dept. of Wood Based Materials and Design

National Chiayi University

Reference

1. Finance (2020) global furniture industry market status and development trend analysis.

Website: https://read01.com/BJK54xj.html#.XxqAwZ4zY2w。ClickClick on Aug 20th 2020

2. (Lora Jones, David Brown & Daniele Palumbo)(2020)The new crown epidemic hits the world economy, nine pictures at a glance

。BBC NEWS Chinese Version。

Website: https://www.bbc.com/zhongwen/trad/business-53249104。

Clikc on Aug 29th 2020。

3. (Stephen Su et al., 2020)Key report on the impact of the global pneumonia epidemic (COVID-19) on Taiwan's industries。IEK Industry Information Network.Website:

https://ieknet.iek.org.tw/iekrpt/rpt_open.aspx?actiontype=rpt&indu_idno=0&domain=0&rpt_idno=422294729。

Click on Sep 20th 2020。

4. Csanady, E., Z. Kovacs, E. Magoss, J. Ratnasingam (2019) Furniture

Production Processes :Theory to Practice. Optimum Design and

Manufacture of Wood Products. Springer Nature Swizerland.

5. CSIL(2020)World Furniture Outlook 2020/2021.

Website: https://www.moneydj.com/KMDJ/News/NewsViewer.aspx?a={bd684700-7279-4bb9-bea2-99fd6f50c493}.

Click on Aug 20th 2020.

6. CSIL(2020)Home office furniture market in Europe. Website:

https://www.worldfurnitureonline.com/research-market/the-european-market-home-office-furniture-0058515.html.

Click on Sep 26th 2020.

7. Guzzini, G. (2020) COVID-19 will change forever the industry of furniture, according to entrepreneurs. Website: https://www.domusweb.it/en/speciali/domusfordesign/2020/the-things-that-covid-19-will-change-forever-according-to-entrepreneurs-in-the-furnishing-world.html. Click on Sep 30th 2020.

8. kamel, A. (2020) Furniture hygiene in a post COVID-19 era. Website: https://greenfc.com/stories/furniture-hygiene. Click on Sep 16th 2020.

9. Russell, T.(2020) Bassett Furniture reports 16.3% drop in Q3 sales.

FurnitureToday. Website: https://www.furnituretoday.com/financial-results/.

Click on Oct 1st 2020.

10. Slaughter, P. (2020) Natuzzi Q2 sales off by a third. Furniture Today.

Website: https://www.furnituretoday.com/financial-results/natuzzi-q2-sales-off-by-a-third/. Click on Sep 29th 2020.

11.Statista (2020a) Leading 10 source countries of household furniture imports in the U.S. 2019.

Website: https://www.statista.com/statistics/673244/leading-source-countries-of-household-furniture-imports-us/

Click on Sep 16th 2020.

12.Statista (2020b) Leading importers of furniture worldwide 2018.

Website: https://www.statista.com/statistics/673244/leading-source-countries-of-household-furniture-imports-us/

Click on Oct 1st 2020.