In Vietnam, Hanoi ranks as high as Binh Duong municipality and Ho Chi Minh city in terms of investment opportunities for the furniture and real estate industries. Here is a brief overview of what the Hanoi furniture and construction markets have to offer.

WOOD AND WOOD PRODUCTS

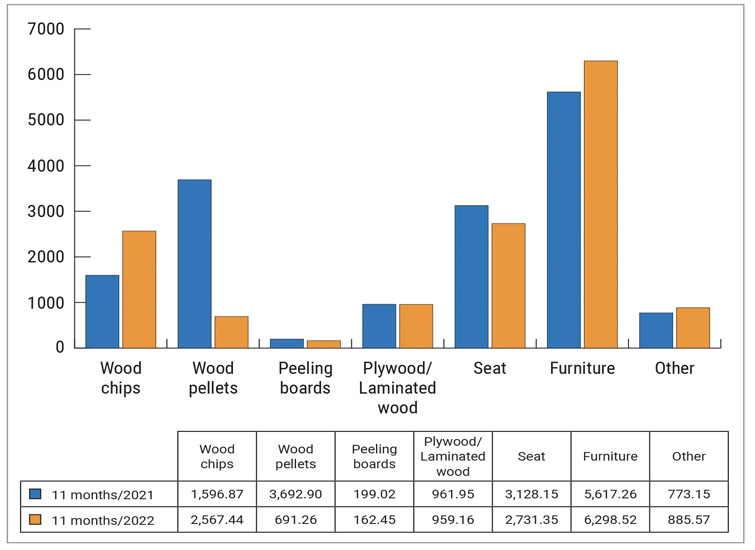

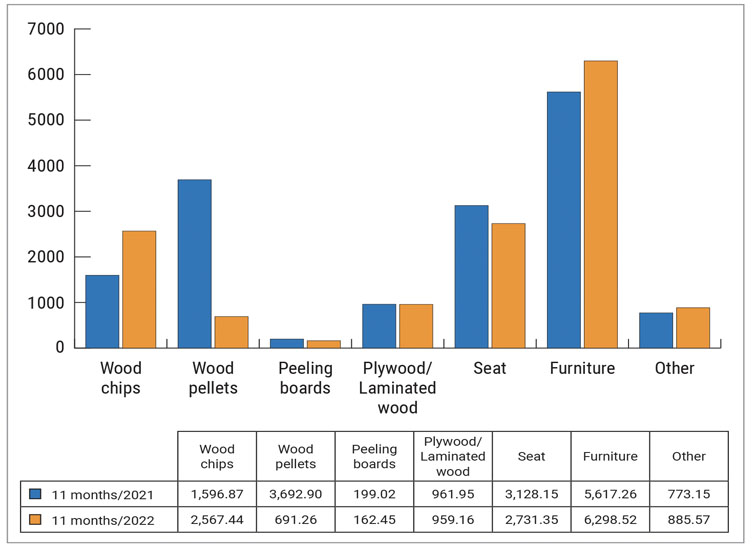

Hanoi produces and exports various wood and wood products, but the segments that have recorded the strongest growth thus far are wood chips, pellets, and wooden furniture, with furniture being the largest proportion in the industry, occupying as much as roughly US$6.3m in the first 11 months of 2022 (Fig. 1).*

According to data by the Fine Arts Association of Ho Chi Minh city and Handicraft and Wood Industry Association of Ho Chi Minh city (HAWA), the average consumption and demand for furniture in Vietnam is $21 per person per year.* This figure by itself might not seem much, but taking into account Hanoi’s population, which is around 8.5 million people as of early 2023* — accounting for about 8.5% of the country’s population, second highest after Ho Chi Minh city — the domestic demand for furniture can exceed over $100m annually.

Furthermore, with Hanoi’s current average population density of about 2,480 people per km2 — 8.3 times higher than the population density of the whole country, and second highest after Ho Chi Minh city, which is 4,375 people per km2 — this density should be a clear indicator of how strong the demand for furniture and furnishings can be in the near future, as Hanoi continues to grow in population.*

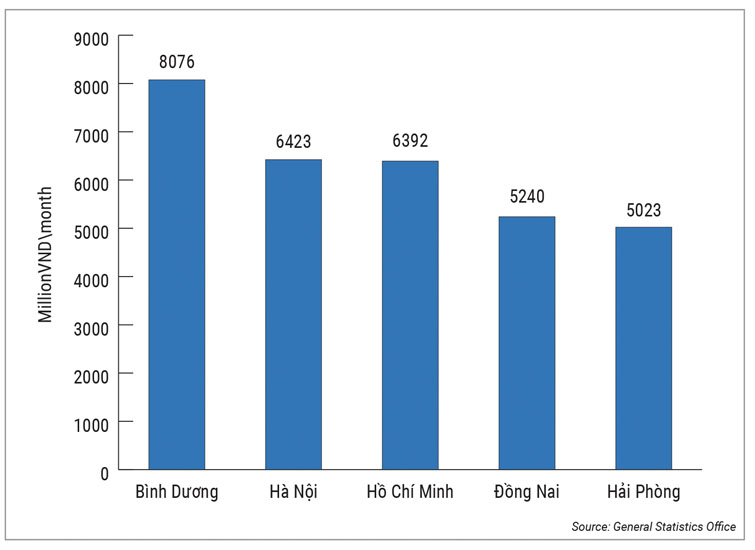

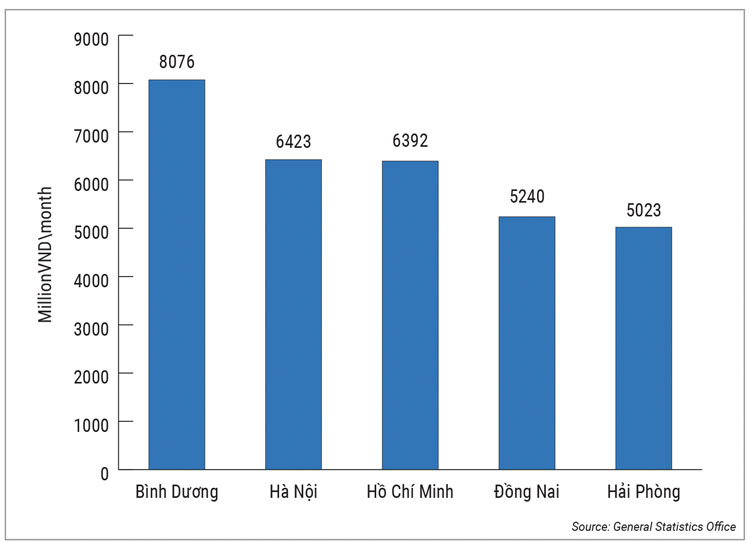

Preliminary results announced by the Population Living Standards Survey 2022 of the General Statistics Office reported that Hanoi ranks second in terms of per capital income in the country with 6,423m Vietnamese dong per person per month, while Binh Duong takes first with 8,076m Vietnamese dong per person per month (Fig. 2).* As of Q1 2023, according to the General Statistics Office, the average monthly income of employees in Q1 2023 was 7m Vietnamese dong person, an increase of 197,000 Vietnamese dong compared to the previous quarter and an increase of 640,000 Vietnamese dong over the same period last year.*

Although per capita income is not high, the demand for high-end furniture in Vietnam is not inferior to that of Hong Kong, Singapore, or other very high-income countries. In fact, Hanoi and Ho Chi Minh city are two markets where the demand for high-end furniture products is rapidly increasing. And to meet this demand, many furniture companies, local and global, have set up in Hanoi, approximating 710; Ho Chi Minh city has the most furniture companies in Vietnam with 1,170 firms, followed by Binh Duong with 715, then Hanoi.*

REAL ESTATE MARKET

The demand for furniture is closely related to the market performance for the real estate, hospitality and construction industries, where there is a need to supply furniture and furnishings for interior and structural works.

According to Phan Dang Chuong, deputy general director of ERNST & Young Vietnam, in the past five years there have been about 400,000-500,000 townhouses and high-class apartments raised in Vietnam.* On average, each apartment uses at least 100-200m Vietnamese dong for interior furnishing and design, which means there is about 100,000bn Vietnamese dong for this particular demand.

However, Vietnam has seen a drop in commercial housing demand as of 2023. Real estate market statistics from Vietnam’s Ministry of Construction reported that commercial housing development projects in Q1 of 2023 have 14 projects with nearly 6,000 units. The number of projects is about 50% compared to Q4 of 2022 and is about more than 63% of the same period in 2022. “The supply of commercial housing in Q1 2023 is still limited and tends to decrease compared to Q4 2022,” commented the Minister of Construction.*

The Ministry of Construction further said that although the market fluctuates a lot, apartments still continue to attract the attention of the target group with real housing needs. The number of new apartment projects opened for sale in Q1 2023 is not much, mainly from the mid-range and high-end segments, concentrated in Hanoi, Ho Chi Minh city, and Binh Dinh.*

Statistics have also shown that the total transaction volume of Q1 2023 only reached more than 106,000 successful transactions, equalling about 65% compared to Q4 2022 and 61% compared to Q1 2022. In this, the number of successful transactions of land plots decreased significantly, and successful transactions of apartments and individual houses increased sharply; there were more than 39,000 successful transactions for individual houses and apartments, while land plot has more than 67,000 successful transactions.*

As for the hospitality sector, Savills Vietnam’s report said that in Q1 2023, hotel guests increased by 220% year-on-year, reaching 1.1 million arrivals, and 339,000 domestic guests increased by 21% year-on-year. The number of international visitors saw an increase of 1,400% year-on-year to 712,000, presumably after borders have reopened.* The tourism sector is making a return, which means the need to supply furniture and woodworking equipment is enhanced to meet the sharp increase in demand for hotel projects supporting the tourism industry.

Assessing the market outlook, Matthew Powell, director of Savills Hanoi, described that the Hanoi market in 2023 is expected to have two new projects with a total of 471 rooms. From 2024 onwards, there will be 66 new projects with 11,123 rooms. Of these 68 projects, the number of five-star hotels accounts for 61%.*

He added: “This is a positive addition to the hotel supply, especially luxury hotels in Hanoi. In addition, the appearance of branded apartments as well as three- to four-star hotels in the inner city and surrounding areas will help increase the diversity of existing tourism products on the market assessment.”

Source:Panels & Furniture Asia.